[UPDATE: April 3rd — added more information about advertising response rates to the first section. This post will be updated as new data comes in.]

The coronavirus pandemic has disrupted our routines and changed how we consume media. Netflix and YouTube streaming has grown so much that they have to limit bandwidth. Video game live-streaming is way up. Spotify music streaming, on the other hand, has gone down.

So—how has the pandemic changed how we listen to podcasts?

Voxnest and Acast report downloads trending upward during the pandemic. Podsights reported downloads staying essentially flat, while Podtrac showed downloads and audiences trending slightly down. Focusing on podcast downloads, however, misses a key element of podcast listener behavior—actual listening.

Podcast publishers and advertisers trust Chartable to analyze and aggregate many different kinds of data. We see over 530 million IAB-certified downloads a month through our analytics prefix from over 7,000 podcasts. On top of this download stream, we also aggregate listening data from thousands of publishers from both Apple Podcasts Connect and Spotify for Podcasters.

By looking at these datasets together, we’re able to shed a bit more light on what listeners are actually doing with the podcasts they’re downloading.

Downloads & listens are down—but there's a silver lining

We looked at a constant subset of approximately 6,000 podcasts, examining their trailing 7-day downloads compared to a baseline starting on February 15th, when the US had just fifteen confirmed cases of COVID-19. We then compared this download dataset to listening data from Spotify and Apple across the thousands of publishers who aggregate this data with Chartable.

The trend is clear: both downloads and listening began to decline in early March, but listening has dropped off much more than downloads have. This is likely because many podcast apps, like Apple Podcasts, will continue downloading podcast episodes even if they are not actually played.

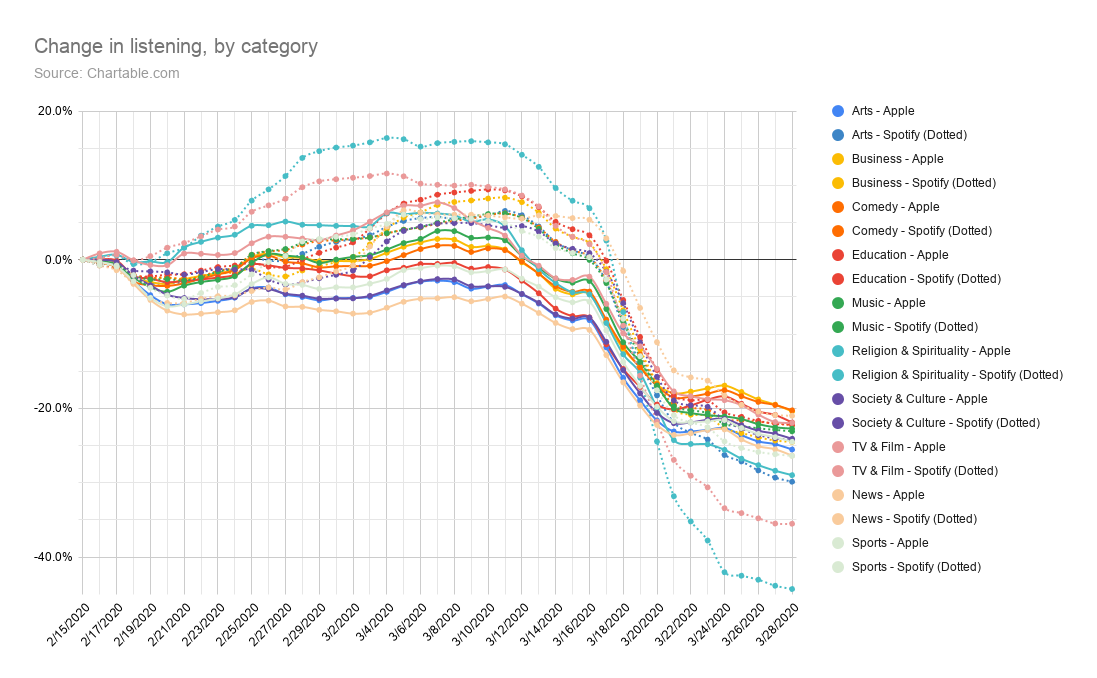

One might wonder if the drop in listening is consistent across genres. For our sample, it is:

It's clear that all genres started declining around the same time. However, there are clear outliers here — Religion & Spirituality, Arts, TV & Film, and Sports are down 30% or more, while Comedy & News, especially on Apple Podcasts, are down 20%. In our sample, Religion & Spirituality is underrepresented compared to podcasts at large, so the effect here may be overstated. However, it makes sense that Sports podcasts are getting fewer listens, as there aren't many sports games being played during the crisis.

However, there is a silver lining here. The listeners who are still tuning in are giving their shows their full attention—listen-through rates are sky-high. An initial analysis of our advertising campaign response rate data shows that listeners are as or more deeply engaged than before, driving steady or increasing returns on ad spend for brands. With many brands reducing their ad spend due to the coronavirus' effect on their business, there is a big opportunity for active advertisers to reach deeply engaged listeners.

Reviews are down—but they’re coming back

Our download and listen data-set is limited to publishers who use Chartable. We also track podcast reviews across all Apple Podcasts countries, for as many podcasts as we can find—including those that don’t use Chartable.

To be clear, reviews are not necessarily an indicator of popularity. We recommend that publishers view reviews as a measure of engagement, because listeners can only review each podcast once, and they tend to be clustered around the release of a new podcast or a new season.

Reviews started dropping in early March, which implies that engagement started dropping then too:

The 7-day trailing review count hit a low of 32% below the baseline on March 21st. There’s some good news here, though: since then, it’s started to recover. We’ll check back in on this metric soon.

Downloads happen at home

According to the Reuters digital news report, “the majority of podcast usage is at home (64%), commuting on public transport (24%) or via private transport such as the car or bike (20%).”

As more states and countries have encouraged or forced workers to stay at home, we’ve seen a decrease in podcasts downloaded over cellular or corporate networks, and a corresponding increase in downloads coming from home internet connections:

One heartening conclusion we can draw from this: it seems that podcast listeners are heeding their governments’ calls to stay home.

What hasn’t changed?

We investigated some other potential hypotheses but couldn’t find support for them in the data.

First, we thought that because people are not commuting, that the time of day that downloads occur might shift. However, looking at data across hundreds of millions of downloads in February and March, the biggest shift we observed was a shift in listening one hour earlier in the day — exactly at the time that daylight saving went into effect in the US. In other words, daylight saving had much more of an effect on download times than the pandemic has—which makes sense, given that many podcast downloads are automatic.

Second, we guessed that the relative popularity of different podcast players would change — for example, if people are listening more at home and less on the go, then they might use different devices more, like their desktop computer, or a smart speaker. So far, this hasn’t happened, though that might be because so much of the download traffic we see is dominated by players that download new episodes automatically. We’ll check back on this in a month or so.

What’s next?

Despite the recent downturn, it's important to note that all metrics we're tracking are still up significantly from the start of the year. Looking to the future, overall download numbers could decline as automatic downloads adjust to new listener behaviors. However, listeners may end up changing their behavior as we all adjust to our new disrupted schedules, and find new time to integrate podcast listening back into our routines. And there's some more good news, too—the rebound in podcast reviews is a positive sign that engagement is returning to normal levels.

For podcast publishers, it's important to focus on audience engagement. Now's the time to ensure you're connecting with your audience, both via your podcast feeds and other channels like email and social media.

For podcast advertisers, it's a great time to explore the medium. Though some advertisers will be pulling back, there are plenty of brands that are increasing spend. Our early analysis confirms that for most advertisers, ad performance is steady or improving, which means there's great opportunity if you have budget to allocate right now.

Ultimately, podcasts aren't going anywhere. Podcast listening will endure through this disruption, and we predict a strong rebound as listeners both adjust to their new routines, and eventually return to their normal patterns. As folks are stuck at home, we're seeing a surge in creativity and activity, including an uptick in new podcasts and episodes being created across the board. The dip in listening won't last, but we can hope the increased creativity will.

A final thank you

Finally, several of us here at Chartable have been affected by the virus, either directly or indirectly—it’s been a trying time. We’d like to express our sincere appreciation for the resiliency of the creators and producers in this industry. We know a lot of you are working through very challenging conditions to continue informing and entertaining the public. Thank you for your work.

Founded in 2018, Chartable builds world-class podcast measurement tools for publishers, agencies, and brands. Agencies and brands rely on Chartable's innovative SmartAds podcast advertising attribution to properly assess the effectiveness of their ad spend. Chartable is trusted by thousands of podcast publishers to handle hundreds of millions of downloads per month. The company's marketing suite helps both indie creators and major media publishers grow their podcasts—Chartable SmartLinks are the only solution in the podcast market to track the effectiveness of marketing and ad campaigns. The company is backed by top investors including Initialized Capital, Greycroft, and Naval Ravikant. To learn more, visit chartable.com.

Download data was aggregated across an anonymous sample of over 6,000 podcasts that received downloads throughout the reporting period of mid-February to late March, 2020.

The median podcast had just over 1,000 downloads in the last 30 days. Podcasts in the sample have anywhere from a few downloads to over ten million downloads in the last 30 days.

39% of the sample has associated Apple Podcasts data; 85% of the sample has associated Spotify data. The difference here is due to the difficulty in gathering Apple Podcasts data. 21% of the podcasts in the sample are associated with a network in Apple Podcasts.

Podcasts in the sample set span all genres. Compared to the million+ podcasts we've indexed in the last 2 years, our sample had more podcasts from news and other cultural genres, and fewer religious and music podcasts. You can view a breakdown of the genres here.

For clarity, we define a "download" as an IAB-certified download of 60 seconds of audio or more through Chartable's analytics prefix. We count one download per "listener" (IP Address + User-Agent combination) per UTC day. "Spotify streams" are reported from Spotify's platform as listens of 60 seconds or more. "Apple Unique Devices" are reported from Apple's platform as devices listening to 5 seconds or more.