Health Insurance in India is ripe for disruption (Highlights only)

Description

The fastest growing segment of insurance in India is individual health insurance. It’s growing steadily at a, well, healthy pace of 20% annually.

But scratch just a little beneath the surface and things don’t appear so rosy. Of the 20% annual growth in revenue, nearly 15% comes from medical inflation. Meaning, existing customers paying higher premiums each year because the costs of treatments are going up.

The growth in the number of customers each year is just around 5-6%.

Health insurance in India is broken from top to bottom. 70-75% of Indians have no health insurance. Of those who do, the largest chunk have free or low cost insurance provided by the government, followed by usually employer provided group insurance. Less than 10% Indians have their own health insurance.

Scratch that. It’s more accurate to call it hospitalization insurance, not health insurance. Because the industry has developed in a way that incentivizes catastrophic illnesses and hospitalization and treatment, not health.

Why, you wonder?

Because much of the industry wrongly incentivizes, for legacy reasons, all the wrong things. Like, large groups that make lots of claims. High commissions to distributors. Expensive procedures. Expensive premiums.

Instead of incentivising the right things. Like, getting the young and healthy covered early on. Insuring blue collar workers. Building products customers actually want. And most importantly, staying healthy.

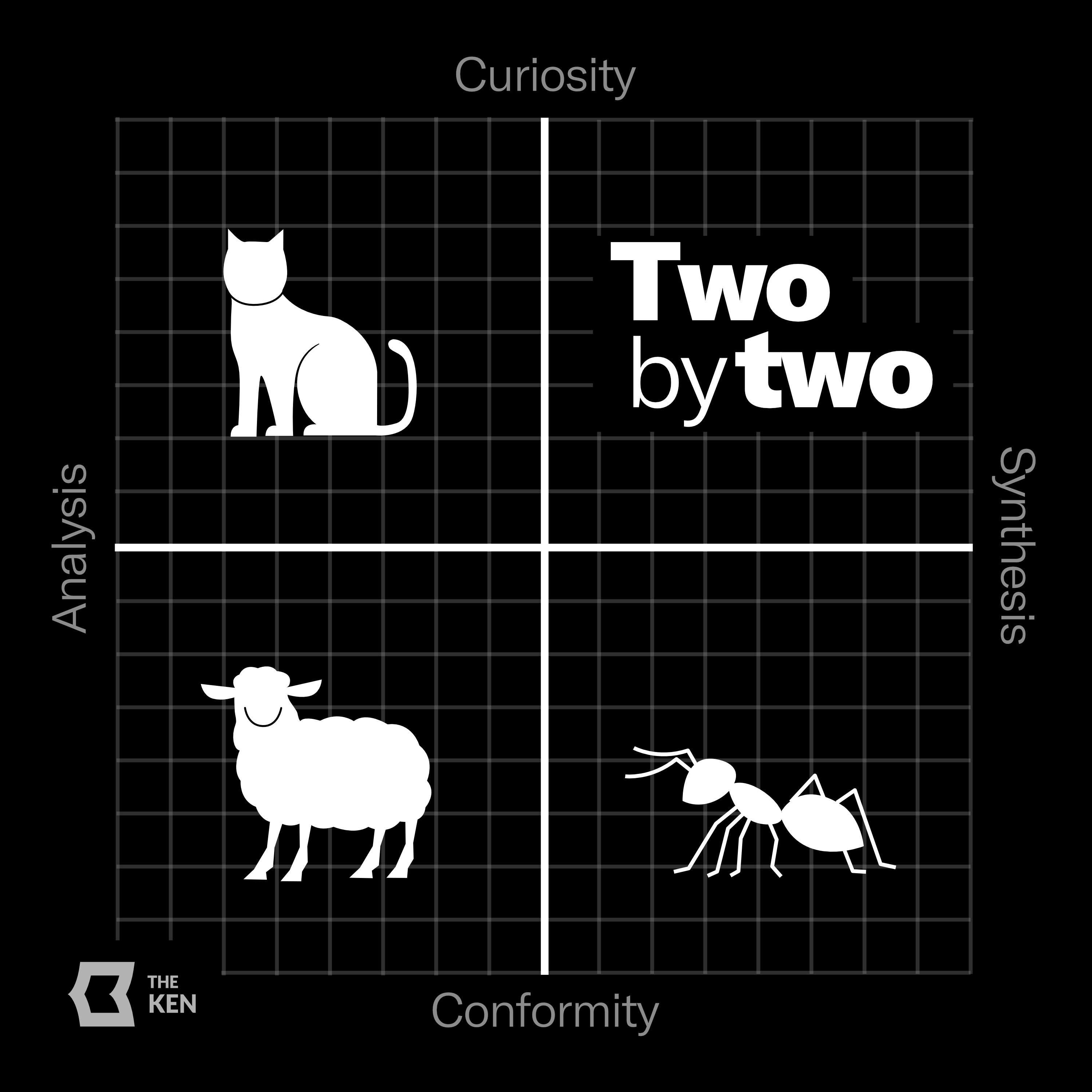

So when hosts Praveen Gopal Krishnan and Rohin Dharmakumar sat down to discuss this complex topic, they decided to invite two guests who had the experience and candour to tell them what needs to change.

Our first guest is Viren Shetty, the Executive Vice Chairman of one of India’s largest hospital groups, the listed Narayana Health. was our first guest. Viren has also been spearheading Narayana Health’s foray into providing its own health insurance, built to address many of the gaps I spoke about earlier.

Our second guest is Shivaprasad Krishnan. Shivaprasad currently runs an investment banking firm, Kricon Capital, but was a part of the founding team at ICICI Lombard, one of India’s first private health insurers. He also has over 3 decades of experience in finance and management.

This episode of Two by Two was researched and produced by Hari Krishna. Sound engineering and mixing is by Rajiv C N.

What you just listened to were just some of the highlights from an almost 90 minute discussion that Praveen and Rohin had with Viren and Shivaprasad. You can listen to full episodes either with a Premium subscription to The Ken or by subscribing to Two by Two Premium on Apple Podcasts.

Of course, you could also wait 4 weeks, because we do make full episodes available for a while after that.

[This is a highlights episode which you listen for free on Spotify, Amazon Music or YouTube or wherever you get your podcasts if you're not a paid subscriber yet]

If you enjoyed listening to this episode of Two by Two or have some thoughts that you’d like to share with us you can always write to us [email protected]. We’ll be back next week with a new episode for you.

More Episodes

Dmart, the retail group in India, is absolutely number one on vision, execution, and consistency. Dmart opened its first supermarket in Mumbai’s Powai suburb in 2002. Like Walmart in the US, it adopted a deep discounting strategy, offering its customers low prices every day. Today, it has 381...

Published 11/21/24

Published 11/20/24

We’ve unlocked this episode for our Basic and Free subscribers for a limited time. Listen to it on your favourite streaming platform for a limited time.

Ola and Uber are in a “late-stage duopoly”.

After spending billions and billions of dollars, they have finally secured pole positions in...

Published 11/18/24